Georgia Summer Insurance Protect Your Home, Car, and Guests This Season

GEORGIA — As temperatures rise and outdoor activity peaks, so do the risks that come with summer in Georgia — from sudden downpours and grill fires to road trip mishaps and unexpected liability. A new seasonal guide is urging homeowners and drivers across the state to review their insurance policies now to avoid costly surprises later.

The guide, published by D.D. Harden Insurance, outlines the most common claims seen in Georgia during summer months — and provides practical tips to make sure you’re fully protected.

Water Damage from Summer Storms

Heavy rainfall, high winds, and clogged gutters can quickly lead to water intrusion and basement flooding — and many Georgians don’t realize these incidents are often not covered by standard homeowners insurance.

Real-world example: A homeowner in Cumming, GA discovered costly basement damage after a storm revealed a blocked gutter. His policy didn’t include flood coverage, leaving him to foot much of the repair bill.

Checklist for homeowners:

-

Clean gutters before storms hit

-

Make sure your yard slopes away from your home

-

Ask your agent if you need additional flood or water intrusion coverage

Auto Insurance for Summer Road Trips

Georgia families gearing up for beach vacations or cabin escapes may not realize that rental cars aren’t always fully covered under their current auto policy. Even short road trips across state lines can expose gaps in coverage.

Example: The Johnsons assumed their policy covered a rental van — but after a minor accident, they learned damage fees weren’t fully reimbursed.

Checklist before hitting the road:

-

Double-check your rental car coverage

-

Know your policy limits for out-of-state travel

-

Keep an emergency kit in every vehicle

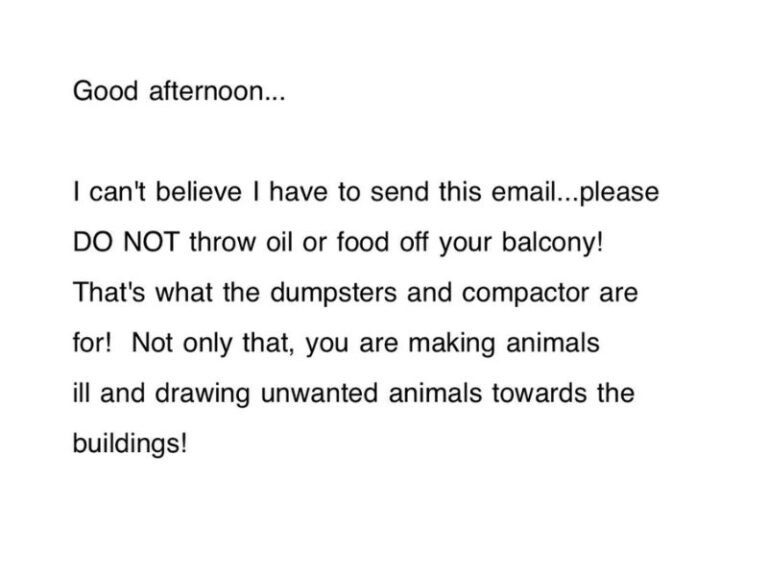

Grills, Fire Pits, and Fire Hazards

Backyard BBQs and summer celebrations often involve open flames, and while they’re fun, they can be risky. Whether it’s a spark from a fire pit or a misfired firework, liability coverage matters.

Example: A backyard fire pit at a BBQ in Georgia led to damage to a neighbor’s fence. Luckily, the homeowner had liability coverage — but many don’t.

Fire safety checklist:

-

Keep fire pits/grills at least 10 feet from any building

-

Always have a hose or extinguisher nearby

-

Never leave a flame unattended

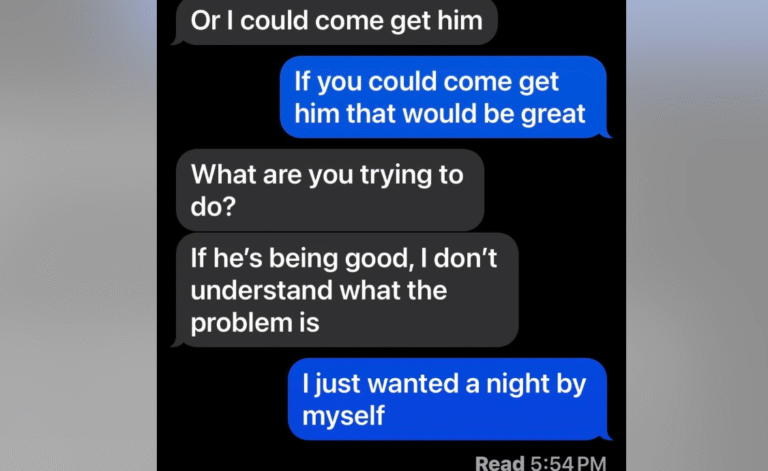

Liability Coverage for Guests and Parties

With pool parties, reunions, and weekend get-togethers, your home becomes a hotspot — and a potential liability zone.

Example: A guest slipped at a pool party and suffered an injury. Medical expenses were covered by the homeowner’s policy, but it could’ve been worse without sufficient limits.

Checklist for liability protection:

-

Review your current liability limits

-

Address loose railings, wet decks, or tripping hazards

-

Consider an umbrella policy for additional protection

Do you feel confident your insurance would cover a summer mishap? Share your experiences or questions in the comments at SaludaStandard-Sentinel.com — your input may help another Georgia neighbor prepare.