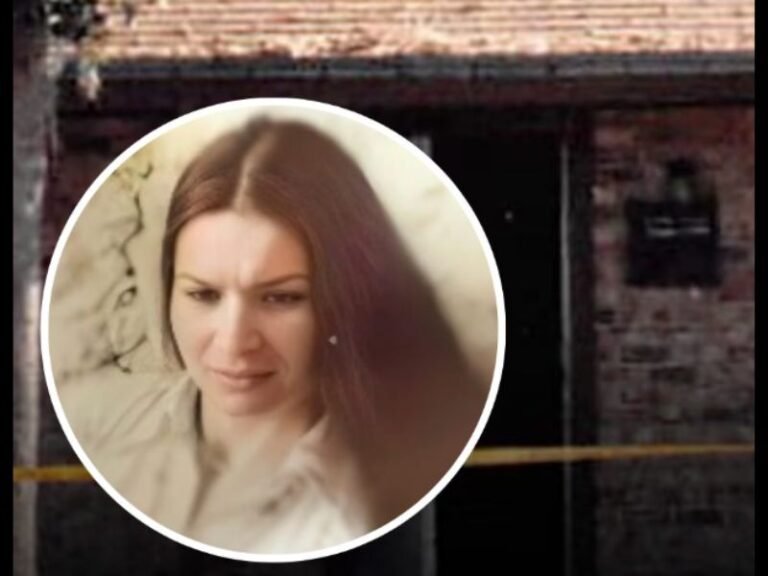

Florida Woman Arrested After Allegedly Spending Nearly $400,000 Mistakenly Deposited by Employer Following Payroll Error

FLORIDA – A Florida woman has been arrested after investigators say she spent nearly $400,000 that was accidentally deposited into her bank account by her employer, instead of reporting the error or returning the funds. According to court records, the money was not a bonus, settlement, or gift, but the result of a payroll mistake that mistakenly transferred a large sum into the woman’s account. Authorities say the funds were quickly spent on personal expenses before the employer discovered the error.

Payroll Error Led to Massive Accidental Deposit

Investigators say the incorrect payment occurred due to a payroll processing error, which resulted in hundreds of thousands of dollars being deposited into the employee’s account. Officials emphasized that the funds legally remained the employer’s property, despite appearing legitimate at first glance. Court documents indicate the woman did not contact her employer or financial institution to report the unexpected deposit.

Funds Allegedly Spent Before Error Was Discovered

Authorities allege that the woman used the money for personal purchases, significantly reducing the balance before the company realized the mistake and attempted to recover the funds. Once the error was identified, investigators were notified, leading to a criminal investigation. Law enforcement officials say the spending activity raised red flags once the employer reviewed account discrepancies.

Why Accidental Deposits Are Not Legally Yours

Under Florida law, money deposited by mistake does not become the recipient’s property, even if it appears to be a legitimate payment. Legal experts note that spending mistakenly deposited funds can be classified as theft, regardless of intent. Authorities stressed that individuals are legally obligated to report unexpected deposits, particularly when the amount is unusually large.

Arrest Made Following Investigation

Following the investigation, the woman was arrested and now faces potential felony charges related to the unauthorized use of funds. Officials have not released additional details regarding her court appearance or possible restitution requirements.

Law enforcement agencies are using the case as a warning, reminding the public that keeping or spending mistakenly deposited money can carry serious legal consequences.

Officials Issue Warning to the Public

Authorities say cases like this serve as a reminder that if money appears in your account unexpectedly, the safest and legally correct action is to immediately notify your bank or employer.

Even if the deposit seems legitimate, spending funds that do not belong to you can result in criminal charges, arrest, and long-term financial consequences. What’s your take — should accidental deposits come with clearer safeguards, or does personal responsibility still apply? Share your thoughts and continue the conversation at SaludaStandard-Sentinel.com.